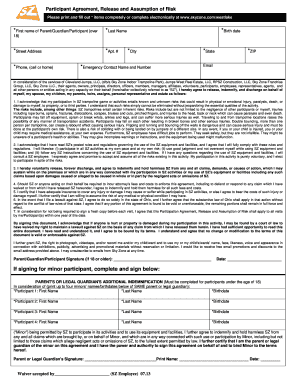

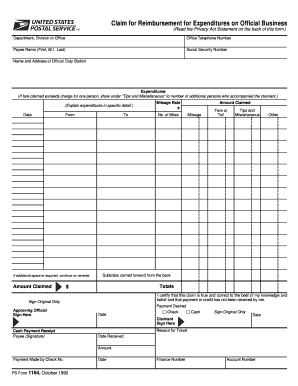

USPS PS 1012-E 2003-2024 free printable template

Show details

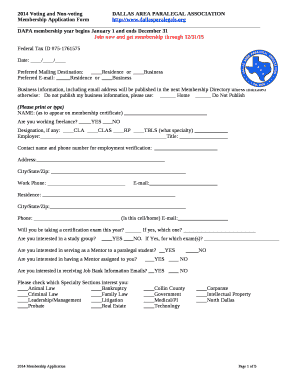

Date Detail Report Sent to Traveler Instructions for Completing PS Form 1012-E Name to be used in naming convention for expense report. Telephone Calls Cost Type of Call B usiness or 5-Min. P ersonal Is Call Listed on Hotel Bill MM/DD/YYYY B P PS Form 1012-E January 2003 Page 1 of 4 5. After completing this form forward the form and all receipts for expenses 50 and over that were not charged to your your PS Form 1012-E into eTravel. Retain copies of any receipts submitted with your expense...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your enter etravel form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your enter etravel form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing enter etravel online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit etravel c form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

How to fill out enter etravel form

How to fill out expenses expense:

01

Gather all the necessary receipts and invoices related to the expenses you incurred.

02

Organize these documents by category, such as transportation, meals, accommodation, etc.

03

Open the expenses expense form provided by your organization or employer.

04

Fill in your personal details, including your name, employee ID or reference number, and the period for which the expenses are being claimed.

05

Find the appropriate section or columns on the form to enter each expense category.

06

Enter the date of the expense, a brief description of the expense, and the total amount spent in the respective column.

07

Make sure to provide any additional information or explanations required, such as the purpose of the expense or any relevant details.

08

Double-check all the entered information to ensure accuracy and completeness.

09

Submit the completed expenses expense form, along with the supporting receipts and invoices, to the designated department or individual responsible for processing these claims.

Who needs expenses expense:

01

Employees who have incurred work-related expenses and are eligible for reimbursement from their organization or employer.

02

Self-employed individuals or freelancers who need to track and report their business expenses for tax deductions or accounting purposes.

03

Individuals who participate in certain programs or events that allow expense reimbursement, such as research studies, conferences, or business trips.

Fill ps form 1012 pdf : Try Risk Free

People Also Ask about enter etravel

What is the purpose of an expense claim form?

What is an expense sheet?

How do you make an expense sheet?

What should be on an expense sheet?

What is an expense reimbursement form?

How do I fill out an expense form?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is expenses expense?

Expenses expense is the account used to record all costs incurred by a business in order to generate revenue and maintain operations. It includes such items as rent, utilities, wages, advertising, and supplies.

How to fill out expenses expense?

1. Gather all your receipts and invoices for the expenses you need to report.

2. Record the date of each expense, the amount spent, and the purpose of the expense on an expense form.

3. If there are any taxes associated with the expense, include that information as well.

4. Attach the receipts and/or invoices to the expense form.

5. Fill out any other pertinent information such as the name of the vendor or the project code if applicable.

6. Submit the expense form and supporting documents to the appropriate department or person for review and approval.

What information must be reported on expenses expense?

The information that must be reported on expenses includes: date of expense, name of vendor, description of expense, amount of expense, payment method, and any applicable tax information.

When is the deadline to file expenses expense in 2023?

The deadline to file expenses in 2023 will depend on the specific policy of the company. Generally, most companies require expenses to be submitted within 30 days of the expense being incurred.

What is the penalty for the late filing of expenses expense?

The penalty for late filing of expenses can vary depending on the company's policy. Generally, the penalty could include being reprimanded, having to pay the expense out of pocket, or being docked pay.

Who is required to file expenses expense?

An individual or organization who incurs expenses related to business activities, such as travel, meals, or other business-related purchases, is typically required to file expense reports or claim reimbursement for those expenses. This requirement may vary depending on company policies or legal requirements.

What is the purpose of expenses expense?

The purpose of recording expenses is to track and document the costs incurred by a business or individual in the process of generating revenue or carrying out its operations. Expenses include various expenditures such as rent, utilities, salaries, supplies, advertising, travel, and maintenance costs. By categorizing and recording expenses, businesses can analyze their spending patterns, control costs, and assess their profitability. Additionally, expenses are necessary for accurate financial reporting, tax compliance, and budgeting purposes.

How can I manage my enter etravel directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign etravel c form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify traveler etravel without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your expenses expense into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I fill out ps form 1012 e on an Android device?

Complete your expense report e form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your enter etravel form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Traveler Etravel is not the form you're looking for?Search for another form here.

Keywords relevant to ps form 1011

Related to business expense

If you believe that this page should be taken down, please follow our DMCA take down process

here

.